Unlocking Opportunities in the USA Commercial Real Estate Market

Navigating the Landscape of Commercial Real Estate:

The USA commercial real estate market is a dynamic and lucrative arena offering a myriad of opportunities for investors, developers, and businesses alike. Understanding the current landscape is essential for those looking to capitalize on the potential benefits within this diverse sector.

Trends Shaping Commercial Real Estate:

Various trends are shaping the USA commercial real estate market. From the rise of flexible workspaces to the increasing demand for sustainable buildings, staying abreast of these trends is crucial for making informed investment decisions. Adapting to the evolving needs of tenants and businesses is key to unlocking the true potential of commercial properties.

Key Investment Considerations:

Investors entering the commercial real estate arena must carefully consider several factors. Location, property type, and market demand are pivotal elements influencing investment success. Conducting thorough due diligence and assessing potential risks and returns are essential steps in making strategic and profitable investments.

Diversification Strategies for Investors:

Diversification is a proven strategy for mitigating risks in any investment portfolio. In the context of commercial real estate, investors can explore diverse property types such as office spaces, retail centers, industrial complexes, and more. Each sector has its unique opportunities and challenges, providing a range of choices for investors seeking to diversify their holdings.

Impact of Economic Factors on Commercial Real Estate:

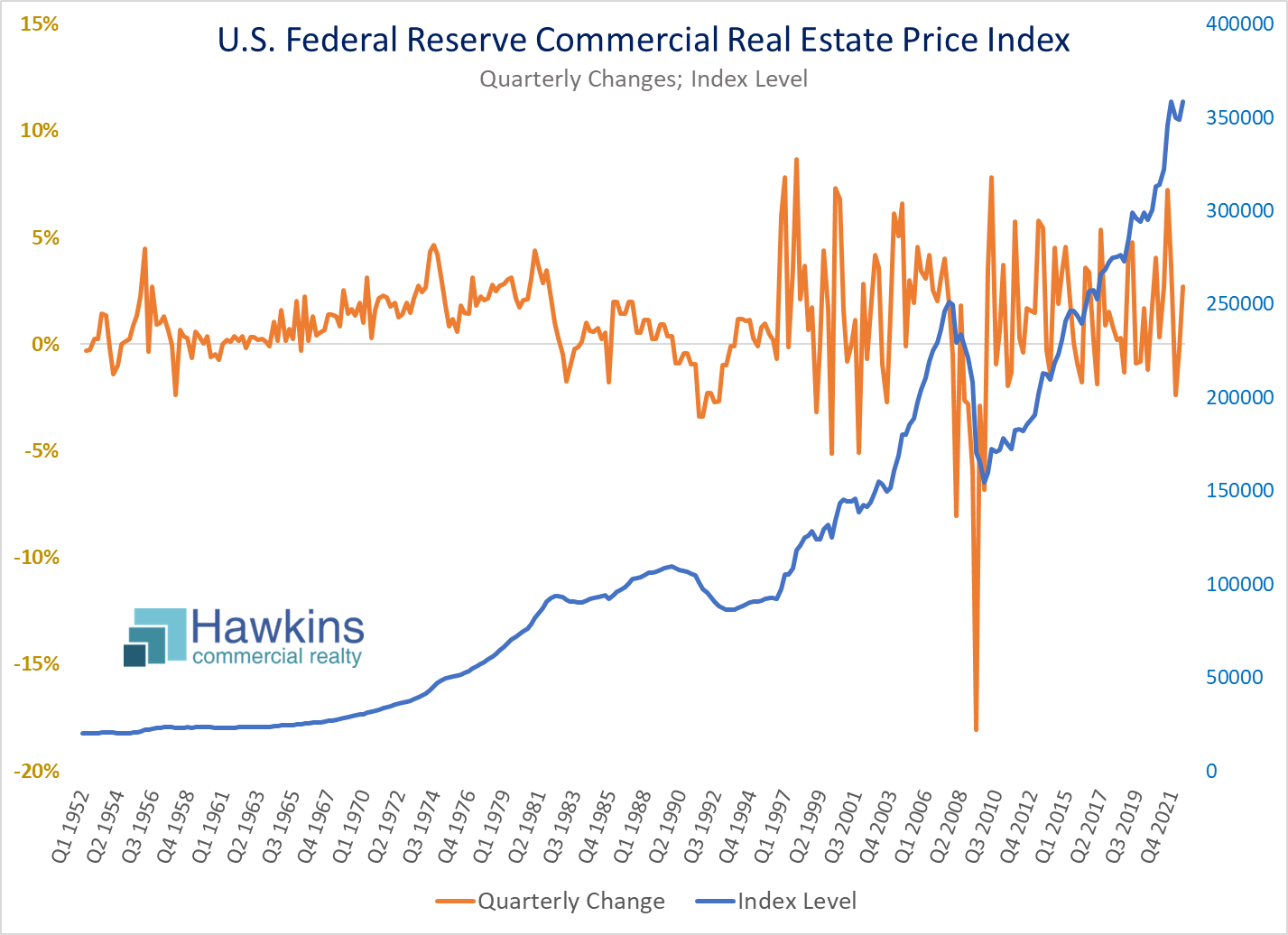

Economic factors play a significant role in the performance of the commercial real estate market. Interest rates, inflation, and overall economic health can influence property values and rental income. Investors should closely monitor economic indicators to anticipate market trends and make informed decisions.

Technological Advancements Reshaping Spaces:

The integration of technology is transforming the commercial real estate landscape. Smart buildings, IoT (Internet of Things) applications, and data analytics are enhancing the efficiency and sustainability of commercial properties. Investors who embrace these technological advancements can position themselves for success in the evolving market.

Navigating Regulatory Landscape:

Understanding and navigating the regulatory landscape is crucial in the complex world of commercial real estate. Zoning laws, building codes, and environmental regulations can impact property development and usage. Investors and developers should work closely with legal experts to ensure compliance and avoid potential setbacks.

Sustainability and Green Initiatives:

Sustainability is becoming increasingly important in the commercial real estate sector. With a growing focus on environmental responsibility, properties with green certifications and energy-efficient features are gaining popularity. Investors who prioritize sustainability not only contribute to a greener future but also appeal to a broader tenant base.

The Role of Commercial Real Estate in Economic Development:

Commercial real estate plays a vital role in fostering economic development. Well-planned developments attract businesses, create jobs, and contribute to the overall growth of communities. Investors who recognize the symbiotic relationship between commercial real estate and economic development can capitalize on opportunities that align with broader societal goals.

In conclusion, the USA commercial real estate market is teeming with opportunities for those willing to navigate its intricacies. By staying informed about market trends, adopting diversification strategies, leveraging technology, and considering sustainability, investors and developers can unlock the full potential of the dynamic commercial real estate landscape.

For more information on USA Commercial Real Estate, visit www.shopgioia.com.